Timeline

3 months

My Role

User Research

Product Design

Web Development

Tools Used

Figma

Excel

Adobe Suite

Team

Senior Researchers

Senior Designers

Developer

Designer (me)

Timeline

3 months

My Role

User Research

Product Design

Development

Tools

Figma

Excel

Adobe Suite

Team

Senior Researchers

Senior Designers

Developer

Designer (me)

Problem

Problem

Operating outside of formal banking institutions excludes people from access to credit, which impacts professional, housing, and savings opportunities.

Why does this matter?

Why does this matter?

1 in 5 Americans is excluded from formal credit

1 in 5 Americans is excluded from formal credit

SOLUTION

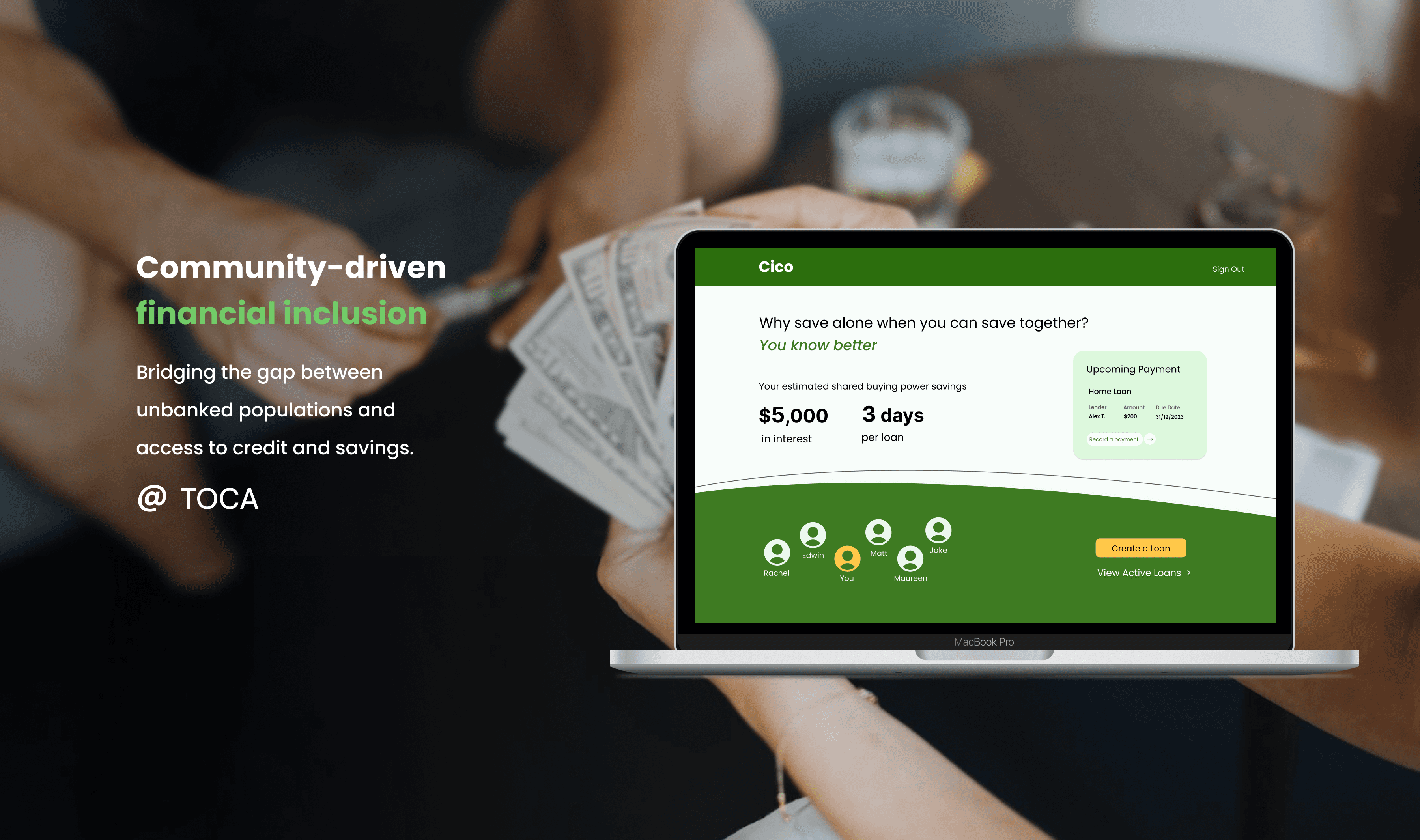

Centering community through secure technology

Centering community through secure technology

Centering community through secure technology

We developed CICO, a web app that integrates existing practices around sending and receiving money in informal groups with modern technology.

We developed CICO, a web app that integrates existing practices around sending and receiving money in informal groups with modern technology.

We developed CICO, a web app that integrates existing practices around sending and receiving money in informal groups with modern technology.

Project timeline

Design process

Flexible payments

Flexible payments

Flexible payments

Users can record payments in different modalities, like checks, ACH, cash, venmo/zelle. Lendees can pay any amount, allowing for personalized micropayments or paying a loan in full at any time.

Users can record payments in different modalities, like checks, ACH, cash, venmo/zelle. Lendees can pay any amount, allowing for personalized micropayments or paying a loan in full at any time.

Make-your-loan

Make-your-loan

Make-your-loan

Start a loan specifying amount, interest rate, repayment schedule, and preferred modes of repayment. Both lenders and lendees can record loans, which will be entered into the system upon confirmation from both parties.

Start a loan specifying amount, interest rate, repayment schedule, and preferred modes of repayment. Both lenders and lendees can record loans, which will be entered into the system upon confirmation from both parties.

Dynamic amortization schedule

Dynamic amortization schedule

Dynamic amortization schedule

CICO provides a dynamic amortization schedule table for each loan, which updates based on user payment frequency. In this way users can receive guidance without the need to stick to the generated schedule.

CICO provides a dynamic amortization schedule table for each loan, which updates based on user payment frequency. In this way users can receive guidance without the need to stick to the generated schedule.

DISCOVERY AND USER RESEARCH

Understanding who we are designing for

Understanding who we are designing for

Understanding who we are designing for

Through our research we set to answer a number of questions, such as: who are underbanked and unbanked Americans? What are their life circumstances? To get these answers we conducted 10 user interviews, direct observations sessions, a competitive analysis, and a literature review.

Through our research we set to answer a number of questions, such as: who are underbanked and unbanked Americans? What are their life circumstances? To get these answers we conducted 10 user interviews, direct observations sessions, a competitive analysis, and a literature review.

Through our research we set to answer a number of questions, such as: who are underbanked and unbanked Americans? What are their life circumstances? To get these answers we conducted 10 user interviews, direct observations sessions, a competitive analysis, and a literature review.

Project timeline

Design process

Design process

Family and friends are the first stop to finances

Family and friends are the first stop to finances

We conducted storytelling sessions of 2 hours with 10 individuals representing unbanked or underbanked Americans to understand their behaviors around finances and collocate them on the spectrum of behavioral dimensions relevant to this project.

We conducted storytelling sessions of 2 hours with 10 individuals representing unbanked or underbanked Americans to understand their behaviors around finances and collocate them on the spectrum of behavioral dimensions relevant to this project.

USER INTERVIEWS

Individual perceptions around finances result in tension and lack of transparency

Individual perceptions around finances result in tension and lack of transparency

Observing people in real life allowed us to create hypotheses on their ingrained patterns, and generate two personas to represent our prospective customer base.

Observing people in real life allowed us to create hypotheses on their ingrained patterns, and generate two personas to represent our prospective customer base.

DIRECT OBSERVATION

DIRECT OBSERVATION

People save and store money outside of formal institutions in groups

People save and store money outside of formal institutions in groups

Group dynamics are a crucial aspect of financial movements outside of formal institutions. People use tools like ledgers, agendas, or spreadsheets to create accountability.

Group dynamics are a crucial aspect of financial movements outside of formal institutions. People use tools like ledgers, agendas, or spreadsheets to create accountability.

Often decisions on the flow of money are based on personal trust. Available digital platforms require bank accounts, or do not support users throughout the entire process of loaning or receiving money informally.

Often decisions on the flow of money are based on personal trust. Available digital platforms require bank accounts, or do not support users throughout the entire process of loaning or receiving money informally.

LANDSCAPE ANALYSIS

LANDSCAPE ANALYSIS

What are the core principles we should design for?

What are the core principles we should design for?

This is the question we set to answer before moving into ideation. In order to facilitate concept prioritization we used objective hermeneutics to extrapolate users' ingrained patterns and identify their core needs.

This is the question we set to answer before moving into ideation. In order to facilitate concept prioritization we used objective hermeneutics to extrapolate users' ingrained patterns and identify their core needs.

IDEATION

Making sure we are solving the right problem

Making sure we are solving the right problem

Making sure we are solving the right problem

Leveraging the user needs and opportunity areas identified in our research, we moved on to brainstorming possible solutions.

Leveraging the user needs and opportunity areas identified in our research, we moved on to brainstorming possible solutions.

Leveraging the user needs and opportunity areas identified in our research, we moved on to brainstorming possible solutions.

Project timeline

Design process

Project timeline

Design process

CONCEPT CREATION

CONCEPT CREATION

How might we make informal loaning transparent and flexible?

How might we make informal loaning transparent and flexible?

As we explored potential concepts, we focused on supporting loaning — the most common type of informal financial transfer. We mapped the solution to the user behavioral types we identified, and chose the one that better aligned with their needs.

As we explored potential concepts, we focused on supporting loaning — the most common type of informal financial transfer. We mapped the solution to the user behavioral types we identified, and chose the one that better aligned with their needs.

USER FLOW

USER FLOW

INTERACTION DESIGN

Building a tech-enabled support

Building a tech-enabled support

Building a tech-enabled support

Realizing the human and financial complexity related to informal financial activities, we audited existing open source solutions and then built a web app with several integrations to ensure our MVP prioritized security and flexibility for our user base.

Realizing the human and financial complexity related to informal financial activities, we audited existing open source solutions and then built a web app with several integrations to ensure our MVP prioritized security and flexibility for our user base.

Realizing the human and financial complexity related to informal financial activities, we audited existing open source solutions and then built a web app with several integrations to ensure our MVP prioritized security and flexibility for our user base.

Project timeline

Design process

Secure technology can streamline existing informal financial rituals

Secure technology can streamline existing informal financial rituals

We designed a prototype with security as a top priority for the MVP launch. The objective was to provide a streamlined, secure and transparent mode of interaction between loan lenders and receivers.

We designed a prototype with security as a top priority for the MVP launch. The objective was to provide a streamlined, secure and transparent mode of interaction between loan lenders and receivers.

We set the tone of the UI copy and modeled interactions on users' existing mental models, promoting group action and trust-building by design.

We set the tone of the UI copy and modeled interactions on users' existing mental models, promoting group action and trust-building by design.

INFORMATION ARCHITECTURE

INFORMATION ARCHITECTURE

LOW FIDELITY WIREFRAMES AND HIGH FIDELITY PROTOTYPES

LOW FIDELITY WIREFRAMES AND HIGH FIDELITY PROTOTYPES

FULL-STACK WEB DEVELOPMENT

FULL-STACK WEB DEVELOPMENT

I developed a usable web app prototype for CICO in the form of an open-source, dockerized application which TOCA deployed to test CICO with a group of users.

I developed a usable web app prototype for CICO in the form of an open-source, dockerized application which TOCA deployed to test CICO with a group of users.

I built the web app using HTML/ CSS/Javascript, Keycloack for security and authorization, and MySQL for data management.

I built the web app using HTML/ CSS/Javascript, Keycloack for security and authorization, and MySQL for data management.